Texas Bonus Tax Rate 2025: Rates & Examples

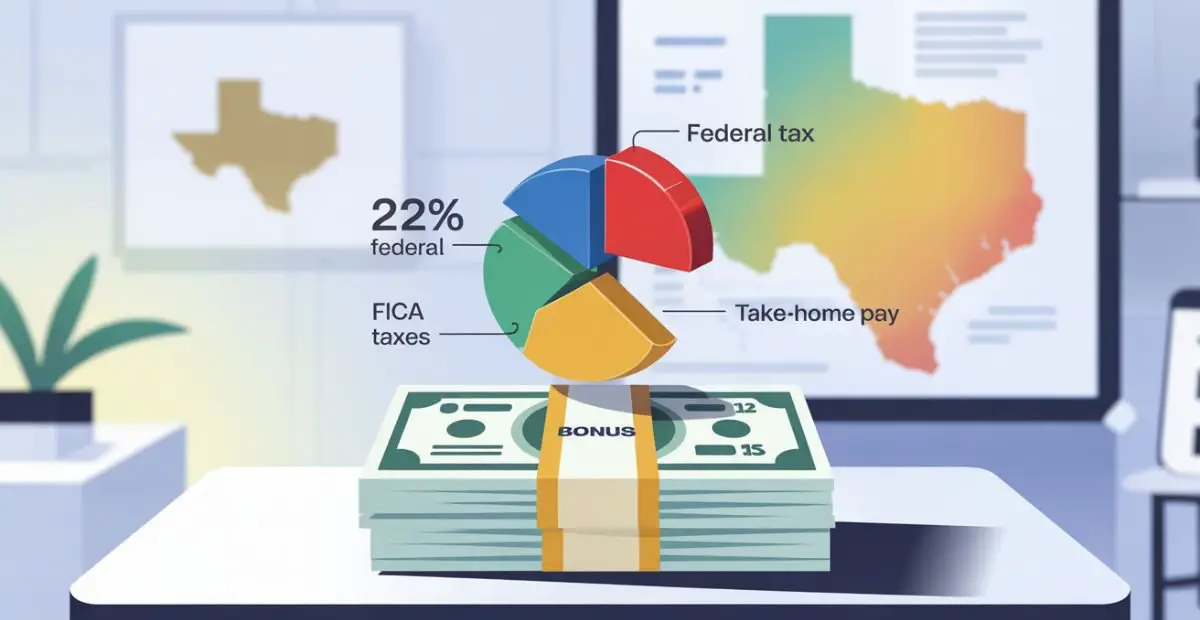

When you receive a bonus in Texas, understanding the Texas bonus tax rate is crucial for proper financial planning.

The good news is that Texas has no state income tax, making the bonus tax structure simpler than in many other states.

For 2025, your bonus in Texas will be subject to a federal flat rate of 22% for amounts under $1 million, plus Social Security and Medicare taxes, totaling about 29.65% in withholdings. If you need quick answers, our Texas bonus tax calculator can do the math for you instantly.

What is the Texas Bonus Tax Rate for 2025?

Understanding Federal and State Tax Components

In Texas, there is no state income tax on your bonus. You only pay federal taxes:

- Federal flat withholding rate: 22% for bonuses up to $1 million

- Higher withholding rate: 37% for any amount over $1 million

These rates come from IRS rules for “supplemental wages,” which include bonuses, commissions, overtime pay, and certain other special payments.

How Employers Calculate Your Bonus Taxes

Employers in Texas typically use one of two methods to calculate withholding:

- Flat Rate Method (most common): Your employer simply withholds 22% from your bonus when it’s paid separately from your regular paycheck.

- Aggregate Method: Your employer adds your bonus to your regular wages for the pay period and calculates taxes as if the total were a single payment. This often results in more taxes being withheld temporarily.

The choice of method is up to your employer, but most prefer the flat rate method because it’s more straightforward.

Additional Taxes That Impact Your Texas Bonus

FICA Taxes and Total Withholding

Beyond the 22% federal tax, your bonus also gets hit with:

- Social Security tax: 6.2% (applies only up to the annual earning limit of $176,100 for 2025)

- Medicare tax: 1.45% (applies to all earnings with no cap)

- Additional Medicare tax: 0.9% (only if your income exceeds $200,000 for single filers or $250,000 for married filing jointly)

This means the standard total tax withholding on a Texas bonus is approximately 29.65% for most employees.

Texas Bonus Tax Compared to Other States

Texas is one of the more tax-friendly states for bonuses. Here’s how it compares:

| State | Bonus Tax Rate | What This Means for Your Paycheck |

|---|---|---|

| Texas | 22% federal + 7.65% FICA | Keep more of your bonus with no state income tax |

| Florida | 22% federal + 7.65% FICA | Same advantage as Texas with no state income tax |

| California | ~32.23% (22% federal + ~10.23% state + 7.65% FICA) | Significantly higher taxes reduce your take-home amount |

| New York | ~30.22% (22% federal + ~8.22% state + 7.65% FICA) | Higher overall tax burden than Texas |

As you can see, receiving a bonus in Texas offers a significant advantage over high-tax states like California or New York.

Detailed Bonus Tax Example in Texas

Calculating Your Take-Home Amount from a $10,000 Bonus

Let’s break down what happens when you receive a $10,000 bonus in Texas for 2025:

- Federal income tax withholding: $10,000 × 22% = $2,200

- Social Security tax: $10,000 × 6.2% = $620

- Medicare tax: $10,000 × 1.45% = $145

- Total taxes withheld: $2,965

- Your net take-home amount: $7,035

So from a $10,000 bonus, you’ll receive approximately $7,035 after all taxes are withheld.

Let’s understand this in complete detail:

Let’s assume you receive a $10,000 bonus in Texas, and your employer uses the flat Percentage Method for federal withholding.

- Bonus Amount: $10,000

- Federal Income Tax Withholding Rate: 22%

- Federal Income Tax Withheld: $10,000 * 0.22 = $2,200

In this scenario, $2,200 would be withheld from your bonus for federal income taxes.

Amount After Federal Withholding: $10,000 – $2,200 = $7,800

Important: This example only shows federal income tax withholding. Your bonus check would also have deductions for FICA taxes:

- Social Security tax (6.2% on income up to the annual limit – $177,900 for 2025)

- Medicare tax (1.45%, with no income limit)

So, the actual net amount received would be lower than $7,800 after FICA taxes are also deducted. For this $10,000 bonus, FICA would be:

- Social Security: $10,000 * 0.062 = $620

- Medicare: $10,000 * 0.0145 = $145

- Total FICA: $765

- Net Bonus (Approx.): $10,000 – $2,200 (Federal) – $765 (FICA) = $7,035

Remember, withholding is an estimate. Your final tax liability is determined when you file your annual tax return.

Quick Reference for Different Bonus Amounts

| Bonus Amount | Federal Tax (22%) | Social Security (6.2%) | Medicare (1.45%) | Total Taxes | Take-Home Amount |

|---|---|---|---|---|---|

| $5,000 | $1,100 | $310 | $72.50 | $1,482.50 | $3,517.50 |

| $10,000 | $2,200 | $620 | $145 | $2,965 | $7,035 |

| $25,000 | $5,500 | $1,550 | $362.50 | $7,412.50 | $17,587.50 |

| $50,000 | $11,000 | $3,100 | $725 | $14,825 | $35,175 |

Will You Get a Tax Refund on Your Bonus?

The 22% federal withholding rate is just an estimate and may not match your actual tax bracket:

- If your tax bracket is lower than 22%: You might get some money back when you file your tax return

- If your tax bracket is higher than 22%: You might owe additional tax when you file

Your final tax liability depends on your total annual income, filing status, deductions, and credits.

Strategies to Optimize Your Bonus in Texas

Timing and Tax Planning Tips:

- Consider retirement contributions: Contributing part of your bonus to a 401(k) or traditional IRA can reduce your taxable income

- Strategic timing: Receiving a bonus in January instead of December might be advantageous if you expect to be in a lower tax bracket the following year

- HSA contributions: If you have a high-deductible health plan, contributing to an HSA can offset some of the tax impact

Official Sources and Helpful Tools:

- For official details on bonus tax rates, refer to IRS Publication 15, the employer’s tax guide

- Learn more about nationwide bonus taxation at TurboTax’s Bonus Tax Guide

- For Texas-specific tax information, check Texas Comptroller of Public Accounts

Frequently Asked Questions about Texas Bonus Taxes

Common Questions About Bonus Taxation in Texas

Is my bonus taxed at a higher rate than regular income in Texas? No, bonuses aren’t taxed at a higher rate overall, but they’re subject to a different withholding method (usually 22% federal withholding), which may be higher or lower than your regular tax bracket.

Can I change how my employer withholds taxes from my bonus? Generally no. The withholding method is chosen by your employer, though you can adjust your W-4 for future regular paychecks.

Do I need to report my bonus separately on my tax return? No, your bonus is included in your W-2 along with your regular wages. You don’t need to report it separately.

Conclusion: Texas Bonus Tax Rate in 2025

The Texas bonus tax rate for 2025 consists of a 22% federal withholding rate plus 7.65% in FICA taxes, totaling approximately 29.65% in tax withholdings. With no state income tax, Texas offers a significant advantage compared to high-tax states, allowing you to keep more of your hard-earned bonus.

While the withholding rate might seem high, remember that your final tax liability depends on your overall tax situation when you file your annual return. By understanding how bonuses are taxed in Texas, you can better plan your finances and make the most of your additional income.